Introducing Brasa on Fogo

What is Brasa?

Brasa is a liquid staking protocol for Fogo that lets you stake FOGO while keeping your capital usable.

When you stake through Brasa, you receive a liquid receipt token called stFOGO that represents your staked position.

This means you can continue to earn staking rewards and still put your position to work across DeFi, without waiting for an unbonding period to participate elsewhere.

What is Liquid Staking?

In traditional staking, tokens are locked: you help secure the network and earn rewards, but your assets are illiquid.

With liquid staking, you deposit FOGO and receive a liquid token (stFOGO) that tracks your stake and accrues value over time.

- Keep earning staking rewards on your underlying FOGO.

- Use stFOGO across DeFi (trading, lending, LPing, strategies).

- Avoid the opportunity cost of fully locked capital.

Deep Dive: How Brasa Works

What is stFOGO?

stFOGO is the liquid token you receive when staking FOGO via Brasa. It serves as on-chain proof of your staked assets and typically appreciates against FOGO over time as staking rewards are accrued to the pool.

What can I do with stFOGO?

- Trade it on supported DEXs (Valiant).

- Use it as collateral in lending protocols (Fogolend, Pyron).

- Provide liquidity and earn additional fees/incentives.

- Compose with other on-chain strategies while rewards continue to accrue.

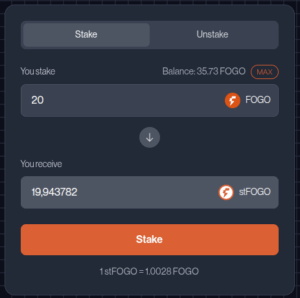

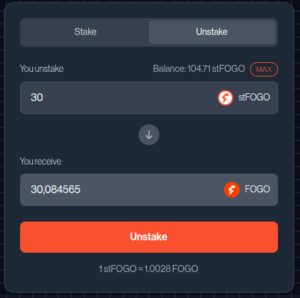

Why is 1 stFOGO not equal to 1 FOGO?

Because stFOGO accumulates staking rewards. Over time, the exchange rate (FOGO per stFOGO) increases, so a single stFOGO gradually represents more underlying FOGO than at the time of minting. This is by design and reflects the yield generated.

Fees

Brasa typically applies a small protocol fee to fund operations, security, and maintenance.

Current fees :

- 5% fee on staking rewards earned

- 0.1% fee on withdrawals

How to use Brasa?

- Connect your wallet to Brasa testnet here

- Select “Stake” tab and enter the amount of Fogo you want to stake.

- Click on “Stake” button and you that’s it, you are now earning money with your stFOGO

How do I unstake?

To exit, you redeem stFOGO back to FOGO through Brasa’s unstaking flow.

You can also use Valiant to swap your stFOGO into FOGO.

Who is behind Brasa?

Brasa is built and operated by Firstset, a staking lab that is an early contributor to Fogo, participating as a validator on the network since Genesis.

In Summary

- Brasa = liquid staking for FOGO.

- stFOGO = your liquid receipt that appreciates as rewards accrue.

- Earn staking yield while keeping your capital usable across DeFi.

- Redeem when you want underlying FOGO.

Final Quiz

Please select or write the correct answer.